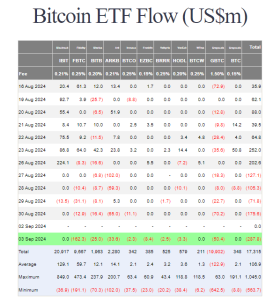

U.S. spot Bitcoin ETFs net outflows totaled $287.8 million on September 3, 2024, marking the fifth consecutive day of outflows, according to data from Farside Investors. The outflows reflect growing caution among institutional investors, particularly as the crypto market faces increased volatility. Leading the pack, Fidelity’s FBTC recorded the largest net outflow of $162.3 million, followed by Grayscale’s GBTC with $50.4 million, ARK Invest’s ARKB with $33.6 million, and Bitwise’s BITB with $25 million. Notably, BlackRock’s IBIT remained stable with no significant inflows or outflows.

Breakdown of Key Outflows

- Fidelity’s FBTC: The largest outflow came from Fidelity’s spot Bitcoin ETF, FBTC, which saw $162.3 million leave the fund. This significant reduction underscores the hesitation among investors during recent market fluctuations.

- Grayscale’s GBTC: Grayscale’s GBTC recorded a net outflow of $50.4 million, contributing to the overall bearish sentiment in the spot Bitcoin ETF market.

- ARK Invest’s ARKB: ARK Invest’s Bitcoin ETF, ARKB, also saw substantial outflows totaling $33.6 million, adding to the broader exit trend among institutional investors.

- Bitwise’s BITB: Bitwise’s spot Bitcoin ETF, BITB, experienced a net outflow of $25 million, further illustrating the cautious sentiment in the market.

- BlackRock’s IBIT: While other major ETFs saw significant outflows, BlackRock’s IBIT recorded no major inflows or outflows on September 3, suggesting relative stability amid the broader exit trend.

Implications for the Market

The U.S. spot Bitcoin ETFs net outflows are indicative of a broader trend of investor caution as the crypto market remains volatile. The five consecutive trading days of outflows may reflect growing concerns over price stability, regulatory uncertainty, and global economic conditions affecting risk assets like Bitcoin.

- Market Volatility: The ongoing market fluctuations have led investors to reconsider their positions in Bitcoin ETFs, with many opting to exit during periods of uncertainty.

- Institutional Sentiment: The net outflows suggest that institutional investors, who typically use Bitcoin ETFs for easier exposure to the asset, are increasingly wary of near-term price movements. This is further compounded by broader concerns about inflation and interest rates that are affecting all risk assets.

Conclusion

The U.S. spot Bitcoin ETFs net outflows on September 3 highlight the cautious approach taken by institutional investors as volatility continues to impact the crypto market. Fidelity’s FBTC and Grayscale’s GBTC led the exit, with notable outflows also seen in ARK Invest’s and Bitwise’s ETFs. With five consecutive trading days of net outflows, the market will be closely monitoring how sentiment evolves in the coming weeks, especially as macroeconomic conditions and crypto-specific developments unfold.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries