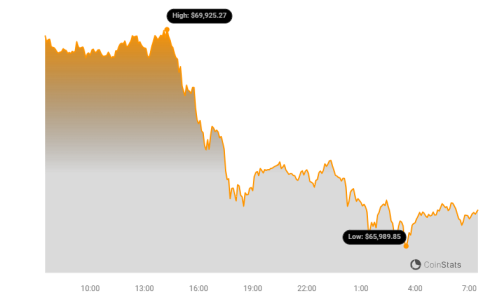

- Bitcoin (BTC) is trading below $66,500, and Ethereum is having trouble staying above $3,300

- The cryptocurrency market dropped by 2.80%, bringing the total market value down to $2.51 trillion

BlackRock CIO Samara Cohen said a Solana ETF doesn’t make sense because there’s no demand for altcoins other than ETH.

Peter Schiff warns the US government will sell all its BTC to stop Trump from using it as a strategic reserve, following a $2 billion Bitcoin transfer.

Crypto Fear and Greed Indicator shows market sentiment at 67 (Greed), down from 74 yesterday and 69 last week.

Latest Market Update:

- #Bitcoin ($BTC) price dropped by 4.70% in the past 24 hours, now sitting at $66,500.

- Major altcoins like #Notcoin ($NOT), #ORDI ($ORDI), #Worldcoin ($WLD), #Solana ($SOL), and #Cardano ($ADA) have seen a decline after notable gains recently.

- #BOOK OF MEME ($MEME) surged by more than 8.82% in the past 24 hours.

- Popcat ($POPCAT) experienced a decline of over 14.21% in the past 24 hours.

- The total crypto market volume in the last 24 hours is $80.75 billion, reflecting a 59.49% increase.

- The current DeFi volume is $4.24 billion, representing 5.26% of the total crypto market volume over the past 24 hours.

- The volume of all stablecoins is now $73.62 billion, accounting for 91.17% of the total crypto market volume in the past 24 hours.

- Bitcoin’s dominance is currently at 54.94%, down by 0.61% over the past day.

Major Worldwide News Update:

1. The US government recently transferred over $2 billion worth of Bitcoin (BTC) seized from the Silk Road, moving approximately 29,800 BTC in two transactions.

This follows previous transfers of 237 BTC and 60 BTC in July, causing market unrest. This action comes after the Bitcoin Conference 2024, where Donald Trump announced plans to hold BTC.

2. In an interview on July 29, BlackRock CIO Samara Cohen stated that BlackRock is not pursuing a Solana ETF or other crypto ETFs due to technical difficulties and low demand.

While Bitcoin and Ethereum meet their criteria, other assets do not. Cohen also mentioned that crypto ETFs could be part of model portfolios by the end of 2024.

3. Peter Schiff predicts that the US government, under President Biden, will sell all its Bitcoin holdings following a recent $2 billion transfer of Bitcoin seized from Silk Road.

Schiff suggests this move aims to prevent a potential Trump presidency from using the Bitcoin as a strategic reserve. The transfer has stirred market speculation about future Bitcoin volatility and government policy on digital assets.

4. WazirX is facing backlash following a controversial July 27 poll on its Withdrawal Management Programme, deemed misleading after a $230 million hack. Critics argue the poll’s options were unfair and potentially illegal.

WazirX co-founder Nischal Shetty clarified it was non-binding and intended for feedback. The exchange is working on recovery efforts, including bounty programs and legal consultations.

5. Two artists, Brian Frye and Jonathon Mann, have sued the SEC seeking clarity on whether NFTs fall under its jurisdiction. Their lawsuit questions if artists must register NFTs and disclose risks before selling.

They argue that treating NFTs as securities would be absurd, likening it to classifying Taylor Swift’s concert tickets as such. The lawsuit seeks relief from SEC enforcement actions.

Opinion: Will Bitcoin’s price break its all-time high and surge to $100K? Why is Bitcoin experiencing volatility today? Is the recent pullback a sign that bulls will overcome the selling pressure?

With Bitcoin dipping from the $70K milestone, are these dips supported? Will Bitcoin reach $100,000? To get latest news Stay tuned us at coingabbar

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.