Vietnam Unveils National Blockchain Strategy with Vision to 2030

In a significant move to position itself at the forefront of blockchain innovation, the Vietnamese government officially unveiled its National Strategy for Blockchain Development on October 22, 2024, through its official website. This comprehensive strategy outlines Vietnam’s ambition to become a regional leader in blockchain technology by 2030, emphasizing the creation of leading blockchain companies, the establishment of testing centers, and the enhancement of legal and infrastructural frameworks.

Introduction to Vietnam’s National Blockchain Strategy

Overview of the Strategy

The National Strategy for Blockchain Development serves as a roadmap for Vietnam’s integration of blockchain technology across various sectors. By setting clear objectives and actionable initiatives, the strategy aims to foster innovation, attract investments, and ensure regulatory compliance, thereby creating a robust ecosystem for blockchain advancement.

Vision for 2030

Vietnam envisions becoming a regional blockchain hub by 2030, leveraging its growing technological infrastructure and skilled workforce. The strategy emphasizes the importance of blockchain in driving economic growth, enhancing transparency, and fostering technological sovereignty.

Key Goals of the National Strategy

Creation of Leading Blockchain Companies

One of the primary goals is to establish 20 leading blockchain companies within the next decade. These companies will focus on developing cutting-edge blockchain solutions, ranging from decentralized finance (DeFi) platforms to supply chain management systems, catering to both domestic and international markets.

Establishment of Blockchain Test Centers

To facilitate research and development, Vietnam plans to establish blockchain test centers in major cities such as Hanoi, Ho Chi Minh City, and Da Nang. These centers will serve as hubs for innovation, providing resources and support for startups and established firms to experiment with and deploy blockchain technologies.

Ranking Among Asia’s Top Blockchain Institutions

The strategy aims to rank Vietnamese institutions among Asia’s top 10 for blockchain research by 2030. This objective underscores the commitment to academic excellence and the promotion of blockchain education and training programs in universities and research institutions.

Key Initiatives and Focus Areas

Legal Framework Improvements

Recognizing the importance of a supportive regulatory environment, the strategy includes significant improvements to the legal framework governing blockchain and digital assets. This includes clear guidelines for the issuance and trading of cryptocurrencies, smart contracts, and decentralized applications (dApps), ensuring compliance with international standards.

Infrastructure Development

Investment in blockchain infrastructure is a cornerstone of the strategy. This involves enhancing internet connectivity, data security measures, and the development of blockchain platforms that can support large-scale applications across various industries, including finance, healthcare, and logistics.

International Cooperation

Vietnam seeks to strengthen international cooperation in blockchain technology by collaborating with leading global blockchain firms, participating in international blockchain forums, and engaging in cross-border research initiatives. This approach aims to integrate Vietnam into the global blockchain ecosystem and foster knowledge exchange.

Role of the Vietnam Blockchain Association (VBA)

Developing Blockchain Platforms

The Vietnam Blockchain Association (VBA) will play a pivotal role in developing blockchain platforms that align with the national strategy. VBA will collaborate with government bodies, private sector companies, and academic institutions to create innovative solutions tailored to Vietnam’s unique needs.

Supporting Legal Frameworks

VBA is tasked with supporting the development of legal frameworks for digital assets, ensuring that regulations are both comprehensive and adaptable to the rapidly evolving blockchain landscape. This includes advocating for policies that protect investors while encouraging technological innovation.

Fostering Community and Education

Beyond technical and regulatory support, VBA will focus on fostering a vibrant blockchain community through educational programs, workshops, and networking events. By promoting blockchain literacy and encouraging collaboration among stakeholders, VBA aims to build a strong foundation for sustainable blockchain growth.

Implications for Vietnam’s Economy and Global Standing

Economic Growth and Job Creation

The implementation of the National Strategy is expected to drive significant economic growth, creating high-tech jobs and attracting foreign investments. The emergence of leading blockchain companies will contribute to the diversification of Vietnam’s economy, reducing reliance on traditional industries.

Enhancing Technological Competitiveness

By prioritizing blockchain technology, Vietnam aims to enhance its technological competitiveness on the global stage. This strategic focus will position the country as a key player in the blockchain sector, attracting talent and fostering innovation.

Increased Transparency and Efficiency

Blockchain’s inherent properties of transparency and immutability will improve efficiency and trust across various sectors. From reducing fraud in financial transactions to streamlining supply chain operations, the adoption of blockchain technology will have far-reaching benefits for both the public and private sectors.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“Vietnam’s National Strategy for Blockchain Development is a forward-thinking initiative that positions the country to harness the full potential of blockchain technology. By focusing on legal frameworks, infrastructure, and international cooperation, Vietnam is setting the stage for sustainable growth and innovation in the blockchain space.”

Mark Thompson, Financial Strategist

“The emphasis on creating leading blockchain companies and establishing test centers demonstrates Vietnam’s commitment to becoming a regional leader in blockchain. This strategy not only fosters innovation but also attracts significant investments, driving economic growth and technological advancement.”

Sarah Lee, DeFi Researcher

“The collaboration between the Vietnamese government and the Vietnam Blockchain Association is crucial for the successful implementation of the National Strategy. By fostering a supportive ecosystem and promoting blockchain education, Vietnam is ensuring that it remains competitive in the rapidly evolving digital landscape.”

Future Outlook

Continued Investment and Innovation

As Vietnam moves forward with its National Strategy, continued investment in blockchain technology and innovation will be essential. Ongoing research and development efforts will drive the creation of new applications and solutions, further solidifying Vietnam’s position as a blockchain leader.

Strengthening Global Partnerships

Strengthening global partnerships will be key to the strategy’s success. By engaging with international blockchain experts and institutions, Vietnam can stay abreast of global trends and best practices, ensuring that its blockchain initiatives remain cutting-edge and effective.

Monitoring and Adapting to Technological Advances

The blockchain landscape is dynamic, with constant technological advancements and emerging trends. Vietnam’s strategy includes mechanisms for monitoring and adapting to these changes, ensuring that the country’s blockchain ecosystem remains resilient and adaptable to future challenges.

Conclusion

Vietnam’s National Strategy for Blockchain Development marks a significant milestone in the country’s pursuit of technological excellence and economic diversification. By setting ambitious goals and implementing comprehensive initiatives, Vietnam aims to become a regional leader in blockchain technology by 2030. The collaboration between the government and the Vietnam Blockchain Association will be instrumental in driving this vision, fostering innovation, and establishing robust regulatory frameworks.

As Vietnam embarks on this transformative journey, the global blockchain community will be watching closely, recognizing the potential impact of Vietnam’s strategic initiatives on the broader cryptocurrency and blockchain landscape.

To stay updated on the latest developments in blockchain technology and Vietnam’s national strategy, explore our article on latest news, where we cover significant events and their impact on digital assets.

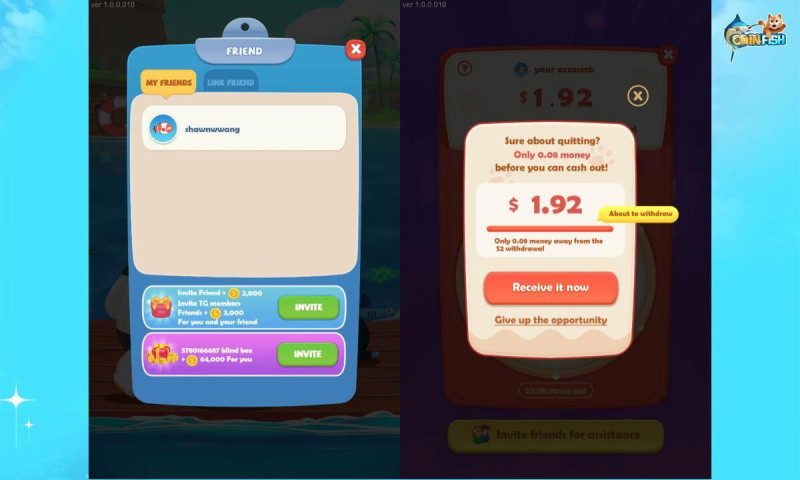

It is reported that COINFISH (

It is reported that COINFISH ( The game features of COINFISH (

The game features of COINFISH ( Furthermore, MEETLabs’ incubated Crypto Gaming project, CryptoPlay, includes a series of large-scale Web5.0 game products such as CoinFishing, CoinHunting, and Monopoliverse (available for both PC and mobile). These games utilize neural networks and AI deep learning technologies to achieve deep matching and dynamic balancing of user parameters and in-game values, delivering highly personalized experiences for each player. This brings significant iterative advancements to traditional gaming products. Among these, CryptoPlay’s first release, CoinFishing, is set to launch in Q4 2024, further enriching and deepening the gameplay experience of COINFISH (

Furthermore, MEETLabs’ incubated Crypto Gaming project, CryptoPlay, includes a series of large-scale Web5.0 game products such as CoinFishing, CoinHunting, and Monopoliverse (available for both PC and mobile). These games utilize neural networks and AI deep learning technologies to achieve deep matching and dynamic balancing of user parameters and in-game values, delivering highly personalized experiences for each player. This brings significant iterative advancements to traditional gaming products. Among these, CryptoPlay’s first release, CoinFishing, is set to launch in Q4 2024, further enriching and deepening the gameplay experience of COINFISH (