Bitwise Executive Forecasts BTC Price to Hit $92K if Trump Wins U.S. Election

In the lead-up to the U.S. presidential election, Jeff Park, Head of Alpha Strategies at Bitwise, has made a bold prediction regarding Bitcoin’s (BTC) future price. According to a post on X (formerly Twitter) and reported by Cointelegraph, Park forecasts that Bitcoin could soar to $92,000 if Republican presidential candidate Donald Trump secures the presidency. This projection is based on a sophisticated analysis utilizing “merger arb-style probability math” and decentralized prediction platforms like Polymarket. Additionally, Mark Cuban, a renowned American entrepreneur, shared his insights, suggesting a temporary surge in crypto markets if Trump wins, but cautioning about potential long-term declines due to proposed economic policies.

Introduction to the Forecast

Who is Jeff Park?

Jeff Park is the Head of Alpha Strategies at Bitwise, a prominent investment firm specializing in cryptocurrency and blockchain technologies. With a deep understanding of market dynamics and predictive analytics, Park is well-regarded for his strategic insights into the crypto market.

Overview of the Prediction

Park’s prediction that Bitcoin could reach $92,000 hinges on the outcome of the upcoming U.S. presidential election. By employing “merger arb-style probability math,” Park charts Bitcoin’s potential price movements against Trump’s electoral odds on Polymarket, a decentralized prediction platform. This method integrates both market sentiment and probabilistic modeling to forecast Bitcoin’s performance under different political scenarios.

Detailed Analysis of the Prediction

Methodology: Merger Arb-Style Probability Math

Park’s approach involves merger arb-style probability math, a strategy traditionally used in arbitrage betting where bettors take advantage of different odds to secure a guaranteed profit. By applying this to Bitcoin’s price forecasting, Park assesses the likelihood of Trump’s victory and its potential impact on Bitcoin’s market performance.

- Probability Assessment: Estimating the chances of Trump winning the election based on current polling data and historical trends.

- Market Sentiment Analysis: Evaluating how different political outcomes influence investor behavior and cryptocurrency adoption.

- Correlation Mapping: Linking the probability of Trump’s win to Bitcoin’s price movements using historical data and predictive models.

Insights from Polymarket

Polymarket is a decentralized prediction market platform where users can trade on the outcomes of real-world events. Park utilizes data from Polymarket to gauge the prevailing sentiments and probabilities regarding Trump’s electoral chances, integrating this information into his Bitcoin price projection.

- User Engagement: High levels of participation on Polymarket indicate strong public interest and confidence in the prediction.

- Real-Time Data: Continuous updates on Polymarket allow for dynamic adjustments to the forecast as new information emerges.

Implications for Bitcoin and the Crypto Market

Potential Surge to $92K

If Trump wins the election, Park believes that Bitcoin could experience a significant price increase, reaching $92,000. This surge could be driven by several factors:

- Regulatory Clarity: A Trump administration might offer more favorable regulatory conditions for cryptocurrencies, reducing uncertainty and encouraging institutional investment.

- Economic Policies: Pro-business and deregulation stances could foster an environment conducive to crypto innovation and adoption.

- Market Sentiment: Positive investor sentiment and increased media coverage could drive demand for Bitcoin as a hedge against traditional financial uncertainties.

Mark Cuban’s Perspective

In contrast to Park’s optimistic forecast, Mark Cuban offers a more tempered view. According to Cointelegraph, Cuban anticipates that while crypto markets might surge for a few weeks following Trump’s election, they could decline in the long term due to the administration’s proposed economic policies.

- Short-Term Gains: Initial excitement and speculative trading could lead to a temporary price boost in Bitcoin and other cryptocurrencies.

- Long-Term Declines: Policies such as import tariffs could lead to inflation, which might negatively impact Bitcoin’s price. Additionally, regulatory measures aimed at controlling inflation could result in tighter restrictions on cryptocurrencies.

Market Reactions and Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“Jeff Park’s prediction underscores the significant influence that political outcomes can have on cryptocurrency markets. While a Trump victory could indeed create a favorable environment for Bitcoin, investors should remain cautious and consider the broader economic implications.”

Mark Thompson, Financial Strategist

“The application of merger arb-style probability math to Bitcoin forecasting is innovative. However, the crypto market is highly volatile and influenced by numerous factors beyond political events. Diversification remains key for investors.”

Sarah Lee, Cryptocurrency Researcher

“Mark Cuban’s insights highlight the dual-edged nature of political influence on crypto markets. While short-term gains are possible, long-term stability will depend on sustainable economic policies and clear regulatory frameworks.”

Potential Risks and Considerations

Regulatory Uncertainty

Even with a Trump administration, the regulatory landscape for cryptocurrencies remains uncertain. Changes in leadership can lead to shifts in policy priorities, affecting market stability.

Market Volatility

Bitcoin’s price is notoriously volatile and subject to rapid fluctuations based on market sentiment, global economic conditions, and technological developments. Predictions, while informative, should be viewed with caution.

Economic Policies

Trump’s proposed economic policies, such as import tariffs and deregulation, could have complex effects on the economy and cryptocurrency markets. The interplay between inflation, market confidence, and investment strategies will play a crucial role in determining Bitcoin’s trajectory.

Future Outlook

Monitoring Political Developments

As the election approaches, closely monitoring political developments and their potential impact on the crypto market will be essential for investors. Changes in campaign rhetoric, policy announcements, and election outcomes will all influence market dynamics.

Diversified Investment Strategies

Given the unpredictable nature of both political outcomes and cryptocurrency markets, adopting a diversified investment strategy can help mitigate risks. Balancing investments in Bitcoin with other assets and sectors can provide stability in volatile times.

Continued Research and Analysis

Ongoing research and analysis are critical for understanding the multifaceted influences on Bitcoin’s price. Investors should leverage diverse data sources, predictive models, and expert insights to make informed decisions.

Conclusion

Jeff Park’s forecast that Bitcoin could reach $92,000 if Donald Trump wins the upcoming U.S. election highlights the intricate relationship between politics and cryptocurrency markets. Utilizing innovative analytical methods like merger arb-style probability math, Park provides a compelling scenario where favorable regulatory and economic conditions could propel Bitcoin’s price to new heights. However, Mark Cuban’s cautionary stance reminds investors of the potential long-term challenges posed by economic policies that could offset short-term gains.

As the election unfolds, both predictions emphasize the importance of understanding the broader economic and political context in which cryptocurrency markets operate. Investors should remain vigilant, adopting diversified strategies and staying informed about evolving market conditions to navigate the inherent volatility and capitalize on emerging opportunities.

To stay updated on the latest developments in cryptocurrency market forecasts and political impacts on digital assets, explore our article on latest news, where we cover significant events and their implications for the financial ecosystem.

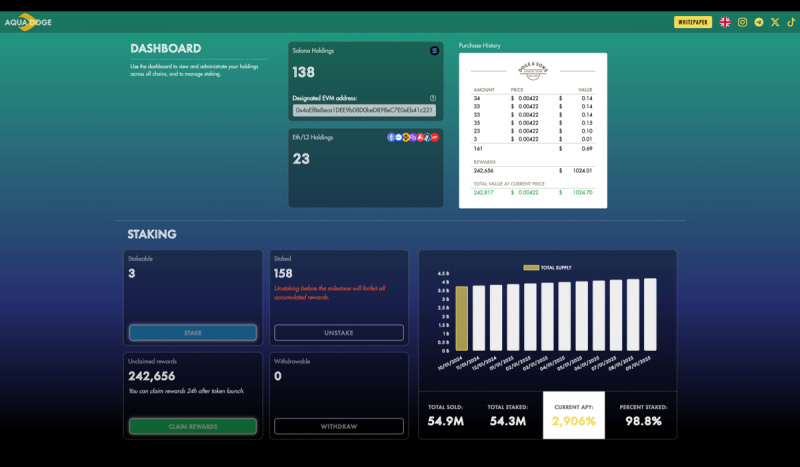

Meme coin gains that beat any adrenaline rush you’ve ever felt

Meme coin gains that beat any adrenaline rush you’ve ever felt