August on-chain metrics Bitcoin Ethereum and other key indicators presented a mixed picture for the cryptocurrency market, according to Lars Hoffman, an analyst at The Block. In his analysis shared via X, Hoffman outlined how August saw a decrease in trading volumes for major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), while stablecoin activity reached new highs.

Decrease in Bitcoin and Ethereum Trading Volumes

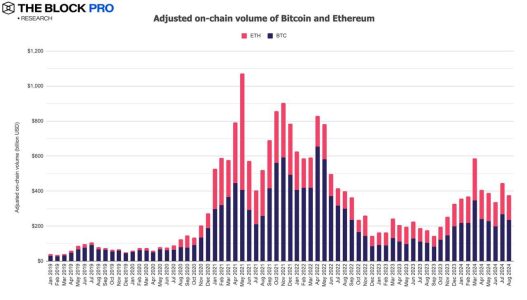

Last month, the average on-chain adjusted trading volumes for both Bitcoin and Ethereum decreased by 15.3%. This decline in trading activity suggests a cooling off in market enthusiasm, possibly due to market uncertainty, profit-taking, or a temporary shift in investor focus.

- Bitcoin (BTC): Bitcoin’s on-chain trading volume fell, reflecting lower transaction activity on the network. This decline in volume might indicate reduced market participation or a more cautious approach from traders and investors amid ongoing market volatility.

- Ethereum (ETH): Similarly, Ethereum saw a reduction in trading volume. Despite being a key player in decentralized finance (DeFi) and non-fungible tokens (NFTs), the decline in on-chain activity suggests a slowdown in these sectors or shifts in user engagement.

Surge in Stablecoin Activity

In contrast to the declining volumes of BTC and ETH, the on-chain adjusted stablecoin trading volume increased by 20.5%, reaching an all-time high. This surge in stablecoin activity reflects growing demand for these assets, which are often used for trading, remittances, and as a safe haven during periods of market volatility.

- Stablecoin Circulation: The circulation of stablecoins also increased by 2.9%, further indicating heightened usage. Stablecoins, being pegged to fiat currencies like the U.S. dollar, are increasingly seen as a reliable medium for transactions within the crypto ecosystem, particularly in times of uncertainty.

Decline in Miner and Staking Revenues

August also saw declines in revenue for both Bitcoin miners and Ethereum stakers:

- Bitcoin Miner Revenue: BTC miner revenue dropped by 10.4%, reflecting lower transaction fees and possibly reduced network activity. This decline could impact the profitability of mining operations, particularly for miners with higher operating costs.

- Ethereum Staking Revenue: ETH staking revenue decreased by 19.3%, a significant drop that could be linked to market conditions and reduced on-chain activity. As staking rewards are tied to network participation, this decline suggests that fewer users are engaging in staking activities.

Ethereum’s EIP-1559 Burn and Spot ETF Outflows

In addition to the above metrics, two other significant developments were highlighted:

- ETH Burn Under EIP-1559: Since the implementation of Ethereum’s EIP-1559 in August 2021, a total of 4.37 million ETH (worth approximately $12.3 billion) has been burned. This burn mechanism is designed to reduce the overall supply of ETH, potentially increasing its scarcity and value over time.

- Spot Bitcoin ETFs: The month also saw a net outflow of $420 million from spot Bitcoin exchange-traded funds (ETFs), indicating a reduction in institutional interest or profit-taking by investors. This outflow contrasts with the broader trend of inflows into Bitcoin ETFs seen earlier in the year, suggesting a shift in market sentiment.

Conclusion

The August on-chain metrics Bitcoin Ethereum report paints a picture of a mixed month for the cryptocurrency market. While Bitcoin and Ethereum experienced declines in trading volumes and miner/staking revenues, the surge in stablecoin activity highlights growing demand for these digital assets as a stable medium of exchange.

The ongoing burn of Ethereum under EIP-1559 and the outflows from Bitcoin ETFs add further complexity to the market dynamics, indicating shifts in both retail and institutional behavior. As the market moves into the final quarter of the year, these mixed signals suggest that investors and analysts alike will need to remain vigilant, closely monitoring on-chain metrics and broader market trends to navigate the evolving landscape.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.