BTC’s PRP Metric Shows Signs of Tightening Liquidity, Hinting at Unfavorable Outlook: BitMEX CGO

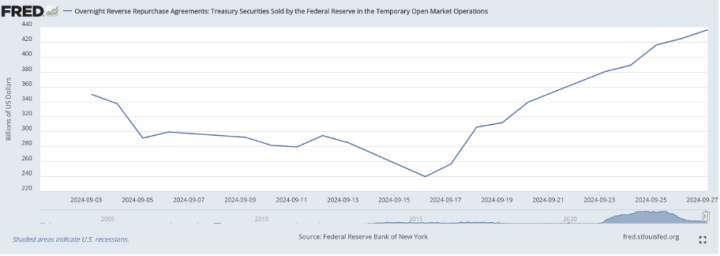

Bitcoin’s recent price rallies may not be as optimistic as they appear, according to Raphael Polansky, Chief Growth Officer (CGO) at BitMEX. In a post on X (formerly Twitter), Polansky highlighted that Bitcoin’s reverse repurchase (PRP) metric is showing signs of tightening liquidity, which could signal an unfavorable outlook for the cryptocurrency market.

Polansky explained that historically, the PRP metric has demonstrated an inverse correlation with Bitcoin’s performance. In other words, when the PRP rises, Bitcoin’s price often struggles, and when it falls, Bitcoin tends to perform better. Given this correlation, Polansky’s analysis points to increased caution despite recent gains in the market.

Understanding the PRP Metric and Its Significance

The reverse repurchase (PRP) metric tracks the activity of liquidity operations in financial markets. When liquidity tightens, it typically indicates that market participants are pulling back from riskier investments like Bitcoin, opting for safer, more liquid assets. This metric is often used to gauge the availability of funds for speculative assets, with a higher PRP reflecting lower liquidity in the system.

For Bitcoin and other cryptocurrencies, liquidity is a key driver of price movements. When liquidity is abundant, market participants have more capital to allocate toward risk-on assets, driving prices higher. Conversely, when liquidity tightens, it limits the amount of capital available, which can put downward pressure on Bitcoin’s price.

Polansky’s observation about the PRP metric rising is, therefore, a potential bearish signal, as it suggests that the flow of capital into Bitcoin may begin to slow, or even reverse, in the coming weeks.

Inverse Correlation Between PRP and Bitcoin Performance

According to Polansky, the inverse relationship between the PRP metric and Bitcoin’s price has been consistent over several market cycles. When the PRP metric is low, it often coincides with periods of Bitcoin price rallies and heightened market activity. During these times, liquidity is readily available, fueling price increases as traders and investors pour capital into Bitcoin.

However, as the PRP metric rises, liquidity tightens, and this often leads to slower growth or price corrections for Bitcoin. Polansky emphasized that recent data shows a marked increase in the PRP metric, which could suggest that the current rally may be short-lived unless there is a reversal in liquidity trends.

Tightening Liquidity and Its Impact on Bitcoin

Bitcoin’s price has seen significant gains in recent weeks, with the cryptocurrency approaching key resistance levels. However, Polansky’s analysis suggests that these gains may not be sustainable if liquidity continues to tighten. The global macroeconomic environment, including interest rate decisions by central banks, plays a pivotal role in this dynamic.

As central banks in the U.S. and other major economies weigh their monetary policies, including interest rate cuts or hikes, these decisions directly impact liquidity conditions. Rising interest rates generally lead to tighter liquidity, as borrowing costs increase and investors become more risk-averse. In contrast, when interest rates are cut, liquidity is injected into the financial system, boosting risk assets like Bitcoin.

Given that Bitcoin’s liquidity is tightening according to the PRP metric, investors may face headwinds despite the cryptocurrency’s recent bullish performance. This tightening suggests that capital allocation toward riskier assets, including Bitcoin, could be restricted, leading to a potential slowdown in its price momentum.

Historical Context: PRP and Previous Market Trends

The PRP metric has served as a reliable indicator of market liquidity and its effect on Bitcoin prices over the years. During the 2017 bull run, for example, Bitcoin’s price surged as the PRP metric stayed relatively low, reflecting ample liquidity in the market. However, as the PRP began to rise toward the end of 2017, Bitcoin experienced a sharp correction, marking the start of a prolonged bear market in 2018.

Similarly, during the 2020-2021 bull cycle, the PRP metric remained low for much of the period, allowing Bitcoin to rally to its all-time high of nearly $69,000 in November 2021. However, as liquidity began to tighten in 2022, Bitcoin’s price corrected sharply, and the PRP metric once again played a key role in signaling the shift in market conditions.

What This Means for Investors

For Bitcoin investors, the current rise in the PRP metric is a signal to approach the market with caution. While Bitcoin has performed well in recent weeks, a sustained rally may be difficult to achieve if liquidity continues to tighten. Investors should be aware that the current price momentum could slow or even reverse if liquidity conditions remain challenging.

Short-term traders may need to adjust their strategies, possibly taking a more defensive approach by securing profits from the recent rally. For long-term holders (HODLers), Polansky’s analysis suggests that while liquidity tightening could lead to a temporary slowdown, the long-term fundamentals of Bitcoin remain intact, particularly as the halving event in 2024 approaches, which historically has been a bullish catalyst for the asset.

Conclusion: Caution Amid Optimism

While Bitcoin has enjoyed positive momentum in recent weeks, the rising PRP metric suggests that investors should not overlook the potential for liquidity challenges to weigh on the market. As Raphael Polansky from BitMEX points out, tightening liquidity has historically been inversely correlated with Bitcoin’s performance, signaling potential headwinds ahead.

Investors are advised to monitor on-chain metrics, such as the PRP indicator, alongside macroeconomic factors like central bank policies, to better gauge the market’s direction. While Bitcoin’s long-term outlook remains optimistic, the current liquidity constraints highlighted by the PRP metric warrant caution in the short to medium term.

Internal Link Reference

For more insights on how liquidity indicators can predict market trends, check out our comprehensive guide on key Bitcoin metrics, where we explore how investors can use on-chain data to navigate market cycles.